How To Pay Employees In A Small Business

Try When I Work for free

When it comes to finding the best way to pay employees, small business owners often feel like they don’t have many options. The good news is that’s simply not true. You can take the hassle out of paying workers by using the right tools and strategies. This guide will relay everything you need to know.

Here are five key things you need to know about paying your employees:

- Understand federal and state payroll laws to promote compliance

- Calculate taxes accurately to avoid penalties

- Make sure you collect accurate employee information

- Identify net pay to help reduce the risk of payroll errors

- Use modern payroll processes to pay your employees on time each week

Check out our guide about how payroll works for small businesses to unlock even more insights!

- Understanding federal and state payroll laws

- How to pay employees in a small business: The logistics

- Things to avoid when paying small business employees

- How When I Work makes paying employees simple

- Pay employees with ease using software from When I Work

Software such as When I Work, can help streamline your business’s payroll efforts, ensuring that employees are paid efficiently and accurately. Start a 14 day free trial today!

Understanding federal and state payroll laws

Payroll laws dictate how you must handle employee wages. These laws protect both you and your team by ensuring fair pay practices. Following the rules will also reduce your risk of compliance issues and fines. Payroll laws can be grouped into one of two broad categories:

Federal

There are many federal laws about payroll, wage taxes, and minimum wage requirements.

The Fair Labor Standards Act (FLSA) is one of the most important federal payroll laws. It establishes overtime pay and minimum wage thresholds. The FLSA also includes recordkeeping rules.

For example, the FLSA requires you to pay non-exempt employees overtime if they work more than 40 hours in a week. The act also mandates that overtime be paid at a rate of at least 1.5 times that of a worker’s regular pay.

State

State payroll laws vary significantly and offer additional protections beyond federal regulations. For instance, some states have higher minimum wage rates than the federal minimum. California has a minimum wage of $16 an hour. You must ensure your payroll processes follow both federal and state rules.

How to pay employees in a small business: the logistics

Payroll logistics involve several critical steps. Each stage ensures your employees get paid the right amount and receive their checks on time. These steps also help with compliance and avoiding fines.

Here’s a basic rundown of how to pay employees so you can avoid errors and keep your team happy.

Calculating taxes

You have to determine how much federal, state, and local taxes to withhold from each worker’s check. This includes income taxes, Social Security, and Medicare taxes.

Accurately calculating taxes helps prevent incorrect withholdings. If you don’t withhold enough, your business may face fines. Employees may owe a lot more than they expected at tax time.

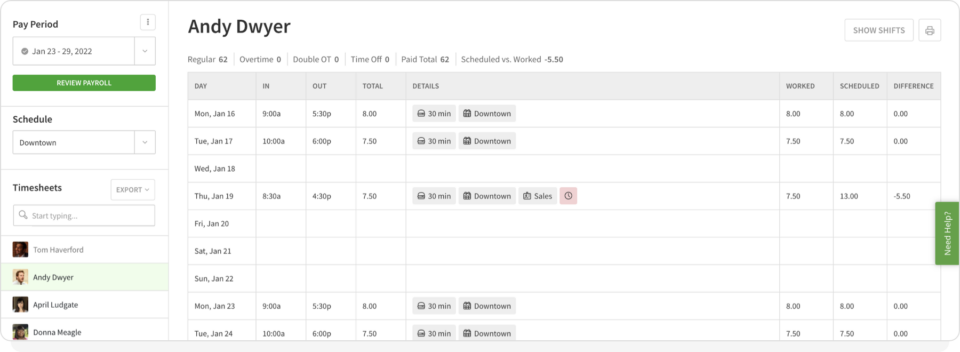

Using a time tracking software like When I Work that integrates with your payroll provider makes this easier. You know you’ll have accurate timesheet data populating your payroll software, so you can rest assured that the tax calculations are based on the right numbers.

Collecting employee information

You will need some key pieces of employee information to set up payroll accurately. Some of the data you’ll need includes:

- Full name

- Address

- Social Security number

You’ll also need them to complete a W-4 form, which determines how much federal income tax to withhold. Collecting and logging their information ensures you’ve got the right details to process payroll.

Identifying net pay

Net pay is the amount each person makes after all deductions. Common deductions include federal and state taxes, Social Security, and Medicare. Health insurance and retirement contributions will also come out of an employee’s gross pay.

Subtracting all approved deductions from a worker’s gross pay is one of the most important parts of payroll processing. Deducting too much will cause friction with your staff and lead to them being underpaid.

Suppose that a person’s weekly gross pay is $1,000, and their total deductions are $200. Their net pay would be $800.

Now, suppose that you mess up the withholdings and deduct only $100. The extra $100 is the employee’s income tax obligations. You don’t notice, and the worker gets paid $900 each week for an entire year.

Come tax time, they could owe taxes on an extra $5,200 (52 weeks x $100 per week). Your employee will be very upset about the surprise tax bill. Your business could face fines for not paying that person’s income tax obligations.

Delivering paychecks

You’ve got to get paychecks in the hands of your employees on time. Nearly half of workers will look for a new job after just two payroll errors. Even a one- or two-day delay can place a major strain on your employee’s wallet.

Direct deposit is the most popular delivery method because it’s convenient for everyone. Ensure timely deliveries to maintain employee satisfaction. Setting up direct deposit allows employees to receive pay directly into their bank accounts on payday. Many banks and credit unions offer early-pay programs, where they can access their direct deposit funds 24 to 48 hours early.

Filing taxes

Your business will also need to file taxes, which involves submitting payroll data to the appropriate federal, state, and local agencies. Make sure you accurately document all income tax withholdings, Social Security, and Medicare taxes. Failing to file on time can result in huge penalties.

Maintaining records

You must maintain detailed records of all employee wages and tax withholdings. Use this information to resolve any disputes or tax audits. These records are also valuable for understanding your payroll costs.

For example, suppose that you incurred an extra $3,000 in overtime costs last month. Reviewing your wage records can help you figure out what happened so you can reduce your payroll expenses.

If you’re using spreadsheets or handwritten documents to run your small business schedule, timesheets, and payroll, this can be a huge problem if you need to produce the records. Using software keeps everything you need for your records, so you can easily jump into When I Work to pull schedules and timesheets if the need arises. You won’t have to worry about accurate data, because it’s all stored for you in the software.

Add a payroll integration to save more time! Learn more about our available integrations and see how you can simplify scheduling and payroll for your team.

Things to avoid when paying small business employees

There’s no such thing as an insignificant mistake when it comes to small business payroll. Even a seemingly small problem can have huge repercussions for your company.

Here are a few common mistakes you need to watch out for:

Missing tax payments

The Internal Revenue Service (IRS) charges underpayment interest when you don’t pay what you owe on time. You’ll incur these charges for any under or missed payments, including unpaid income, Social Security, and Medicare taxes.

The failure-to-pay penalty is one-half of a percent each month. You will continue to accrue interest charges up to a max of 25% of the tax amount.

Most states have similar penalties. If your state requires you to pay income tax on worker wages and you fail to do so, your business will incur penalties from the IRS and the state.

Not staying up to date on payroll laws

Payroll laws can change. If you don’t stay up to date on them, you could incur fines and other penalties. Regularly review federal and state payroll regulations to stay in compliance. For instance, changes in minimum wage rates or tax withholding rules require adjustments to your payroll processes.

Pay attention to changes and enforcement dates. Many laws take effect at the start of the calendar year. However, some rules may go into force mid-year.

If you miss a change and fail to adapt, you could face fines or owe your employees back pay. For example, suppose that your California business employs five minimum-wage workers. California’s minimum wage went from $15 an hour in 2023 to $16 an hour in 2024. However, you didn’t update your payroll system to reflect the change.

In this scenario, you paid your workers $1 too little for 20 weeks. Assume that all five of them worked 40 hours a week for that entire time frame. That translates to 800 hours worked, which means you owe each of them $800 in back pay. In total, you would have to pay $4,000. You could also be fined for violating minimum wage laws.

Not accurately classifying employees

One of the biggest mistakes involves misclassifying workers. There are two common types of misclassification. One mishap involves classifying employees as independent contractors or vice versa. An employee is entitled to certain benefits and protections. If you treat an employee like a contractor and violate their rights, you could face severe fines or even a lawsuit.

The other mistake involves failing to pay salaried workers overtime. Exempt salaried workers are not entitled to overtime, even if they work more than 40 hours in a week. However, non-exempt salaried workers are eligible for overtime pay.

Speak to a labor law professional about worker classifications to ensure you are not mislabeling any of your workforce. This way, you can avoid back taxes, fines, and lawsuits.

How When I Work makes paying employees simple

Does paying your staff sound like a headache? It certainly can be, especially without the right tools. The good news is that there are better options out there, like When I Work.

When I Work is a robust employee scheduling solution that makes it easy to plan and customize shifts. All work hours and wage data will be in one place, saving you time and preventing errors from uploading and syncing. It also integrates with your favorite payroll provider, so you can save time and reduce errors in your payroll process as well.

Instead of copying and pasting hours from one software to another, you can let When I Work do it all automatically.

That’s not all! When I Work also includes a time clock, a secure messaging app, and automatic scheduling capabilities. Change the way you manage your business with When I Work.

Pay employees with ease using software from When I Work

Effective payroll management is essential for your small business. You need to learn payroll laws, calculate taxes accurately, and maintain detailed records to protect your business and your team.

When I Work offers a comprehensive solution to streamline your payroll process and integrates seamlessly with payroll providers to save you even more time. Our payroll integrations, especially the one to our preferred partner, Rippling, help you connect scheduling and payroll in one streamlined workflow, so you can focus on running your business, instead of reconciling timesheets.

Sign up for a free trial of When I Work and make building schedules and paying employees quick and easy.

When I Work preferred payroll partner

Make payroll simple with our preferred partner Rippling, an all-in-one platform for payroll, benefits, and compliance. Together, When I Work and Rippling help you save hours every week while reducing errors, staying compliant, and getting your team paid on time.