How To Calculate A Direct Labor Budget (With Formulas & Examples)

Try When I Work for free

You budget for everything, including supplies, rent, marketing, and labor. Especially your direct labor budget, which can make up about 70% of your costs, depending on your industry. Runaway labor costs can decimate your profits. Budgeting for labor means taking into account how much it will cost to achieve production or service goals, both financially and in actual labor.

That’s not all, of course.

When you get your labor budget wrong, you get your pricing wrong. Even worse, you frustrate current employees by being either under- or over-staffed. Your hiring practices are a shot in the dark, since you aren’t able to predict when you should (and shouldn’t) be adding new employees.

Creating a direct labor budget is especially important for shift-based workers and their managers because it helps plan shifts and affects the employee schedule. It’s a critical piece to optimal workforce management.

There are many reasons your labor budget could be off. Customer demand was more than you expected, overtime costs caught you by surprise, or employee productivity was less than you anticipated. Perhaps managers aren’t communicating labor issues well. Whatever the reason, we’re going to show you how to calculate a direct labor budget, with examples, and tell you why it’s important not only to you, but also your employees.

How do you calculate your direct labor budget?

Calculating the direct labor budget involves knowing your direct labor costs and required direct labor hours to accomplish your organization’s goals.

1. Calculate your direct labor cost.

Direct labor costs start with a 30,000 foot view of what you spend on labor. Your goal is to figure out the cost of each hour worked for employee segments. That includes payroll (both salary or hourly), but also overtime and other employee benefits. In addition, if you have a mix of shift-based and salaried workers, you’ll need to calculate differently so that you have a one-to-one comparison.

In the example below, we’re figuring out labor costs on a weekly basis.

Shift worker: $/hr x hours/week = hourly labor cost per week

Salaried worker: salary ÷ 52 weeks = salaried labor cost per week

You could also calculate them per hour. With shift workers, you already know their hourly pay (though you’ll still add in benefits and overtime). For salaried workers, it might look like this:

Salaried labor cost per week ÷ 40 hours = salaried labor cost per hour

You would also do this for payroll, overtime, and benefits. You will want to use a similar approach to break them all down to an equal time unit (like weekly or hourly). Then, you would add them all together to find the total labor cost.

Payroll + overtime + benefits = total direct labor cost

With overtime, if it’s inconsistent, you may want to take an average of all overtime hours at each pay level. The following example calculates an average overtime on a yearly basis. You could break this down further to weeks or even hours:

Total yearly overtime expense for $20/hr employees ÷ number of $20/hr employees = average per $20/hr employee each year

Average ÷ 52 = average weekly overtime costs for $20/hr employees

Weekly overtime costs for $20/hr employee ÷ 40 hours = average overtime costs each labor hour

Once complete, you see how much your direct labor costs are at a fairly exact amount based on the time set you used (hour, week, month). Again, the important thing is to work it all down the same time unit, preferably hours.

You can even build the work schedule around your labor budget forecast. Try it free with When I Work.

2. Know what your production or service goals are.

How many widgets do you need to produce? What kind of service demands are your customers making?

You’ll be looking into past sales and customer demand data. Using that information, you need to be able to forecast what your production goals should be. They may change based on seasonal or general customer demand, but the main thing is to come up with a standard production or service unit that you’ll use for calculating. It may be widgets produced or appointments booked, depending on your business.

3. Know how much labor is involved.

You need to know how much time it takes to accomplish your goal. There’s a set amount of labor involved in completing the production or service unit you previously defined. It includes every step of the process you are responsible for in getting a product or service from start all the way to completion to the customer. For example:

Production hours + inspection hours + customer interaction hours + shipping hours = total labor hours per unit

Since you know what your production or service goals are, and you now know how many labor hours are involved, you can calculate direct labor hours to budget. Here’s an example:

Number of desired units x number of labor hours to complete a unit = total budgeted direct labor hours

There may be some variance on that formula if you have a mix of shift and salaried workers involved in the process. You’ll want to find the labor cost per productivity unit in a way that equally reflects those differences so that their contributions don’t skew the total.

4. Apply the budget formula to make sure your pricing is correct.

At this point, you should be able to see if what you’re charging customers covers the total cost it takes to produce. Often, the costs of materials or overhead, which are easier to calculate, are taken into consideration while the direct cost of labor is left to a best guess.

After that, when you have this information, you can make some real decisions and create a direct labor budget.

As a manager, you should be calculating a direct labor budget based on your decision-making calendar. For example, if you are a seasonal business, and you bring on extra labor and materials during high productivity times, you’ll want to revisit your labor budget before you begin making hiring decisions prior to those seasons.

You will definitely want to calculate your labor budget before overall budgetary decisions are made. A periodical and systematic approach (for example, quarterly) will help you keep your finger on the labor costs of your company and prevent them from running away from you.

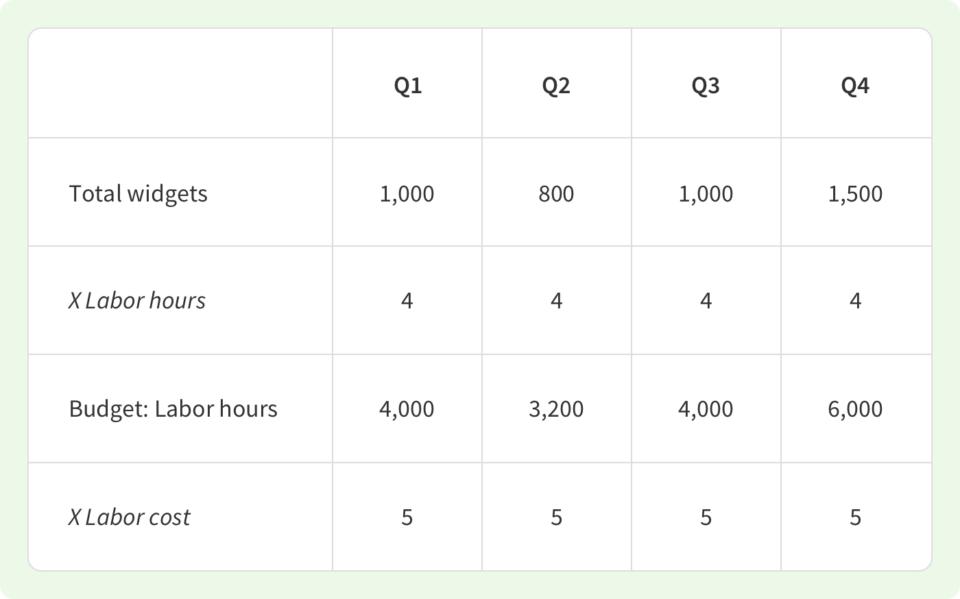

Direct labor budget formula examples

Based on the previous numbers, here are a few direct labor budget formulas to start with:

Production Goal x Direct Labor Hours = Budget Direct Labor Hours

Budgeted Direct Labor Hours x Direct Labor Cost = Budget Direct Labor Cost

Those are your basic formulas, and once you have them, you can plug your own data into them easily enough. Let’s say you are going to calculate this every quarter. You start by determining how many widgets or service units you want to produce:

You can see why it’s important to figure out the labor hours for each production or service unit, and the labor cost per hour. And once you know those, you can easily calculate budgets. (Though it would be wise to regularly revisit the labor hours and labor cost calculations to make sure they’re accurate, as those will change over time and with changes in employees.)

Did you know that you can use labor budget forecasting to help you build a better employee schedule? You can create a work schedule that’s built on customer demand and makes for happier employees. Try When I Work for free to see how easy it is, and how much your team will love it.

How the labor budget impacts your employees

It’s easy to get lost in the numbers of the process and forget that this is about your employees, too.

You can optimize your labor budget all you want, but they are the ones who are going to be working those hours. To start, you can’t leave them out of all of your equations and treat them as calculations instead of people—their satisfaction has an impact on your bottom line, too.

First, consider consulting your employees before making decisions that affect them directly. For instance, involve them in the process when you’re calculating how much labor it takes to complete a production unit. Ask those doing the actual work, not just their managers. Get their feedback.

The best time to start is right now, and the best place to start is with your employee management software. Dig in and see what sales forecasting tools are available. Next, gather overtime and other payroll data from your scheduling and bookkeeping software. Finally, hit the production floor and start talking to employees about how long it takes to do the job.

From here on out, make informed decisions when it comes to budgeting, hiring, scheduling, and sales.

Make employee scheduling easier, and use labor budget forecasting for optimal efficiency. You can start now, for free. Sign up for your free trial of When I Work today!

Direct labor budget FAQs

What is a direct labor budget?

A direct labor budget is a piece of a company’s overall budget that estimates the amount and cost of labor needed to meet outlined production goals. Those goals can be for the quarter or the year. Your direct labor budget is used to plan for expenses, determine staffing needs, help make pricing decisions, and find any inefficiencies in the production process.

What’s the formula to calculate direct labor costs?

The direct labor cost formula is:

Direct labor hours worked x direct labor cost per hour = direct labor cost

You’ll multiply the number of hours your employee spends on the production or service by their labor cost per hour, which includes their wages, benefits, taxes, insurance, and any other related costs (like bonuses or training). That number will give you your direct labor costs.

Why is labor budgeting important?

Labor budgeting is important for your business because it helps you map out one of your biggest expenses, and the one that can change the most at any given time. Budgeting for your labor costs can help you plan your staffing levels, streamline your operations, make decisions about pricing, and even boost your bottom line.